are raffle tickets tax deductible australia

If you get something in return for your donation such as a raffle ticket thank-you card or ribbon its not considered a gift and you cant claim it. Tax deductible donations are a great way to give your tax refund a boost while contributing to a worthy cause you care about.

Felicitation Certificate Template New Sample Business Thank You Letter For Attending An Event Va Donation Letter Donation Letter Template Certificate Templates

Are raffle ticket donations tax deductible.

. This is because the purchase of raffle tickets is not a donation ie. People who make gifts or donations to your organisation can deduct those gifts for their own income tax purposes that is the donor can claim the donation as a deduction when filing their. Unfortunately support via our raffle games are not tax deductible.

Give yourself a chance to win big and feel confident that your funds support vital Red Cross work. In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions. It really is the definition of a win win.

This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. You cannot claim a deduction for a purchase for example raffle tickets. When you get a ticket youre signing up for a chance to win in a raffle.

X must report 13333 as the gross winnings in box. In Western Australian a raffle depending on its terms and conditions can be classified as either a standard lottery a permitted lottery or a permitted amusement with prizes. A raffle is a lottery where people buy tickets for a chance to win the prizes offered in the raffle.

Funds that are donated in exchange for benefits such as raffle tickets fundraising chocolates or fundraising dinner tickets however genuine are not tax deductible. Related Not-for-profit Law resources This fact sheet covers raffles. If the prize pool is 30000 or more the raffle is classified as an art union gaming activity.

Jude Dream Home tickets arent tax-deductible. There are two different methods for claiming work related motor vehicle expenses and each have different record keeping requirements. The sale of tickets in a raffle and the acceptance of a persons participation in a game of bingo by a registered charity gift deductible entity or government school are GST-free provided they do not contravene state or territory law.

For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution. Raffle tickets and lottery syndicates Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates. Raffle or art union tickets for example an RSL Art Union prize home items such as chocolates mugs keyrings hats or toys that have an advertised price the cost of attending fundraising dinners even if the cost exceeds the value of the dinner.

Donations of 2 and over are tax-deductible. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. You cannot receive anything in return for your donation.

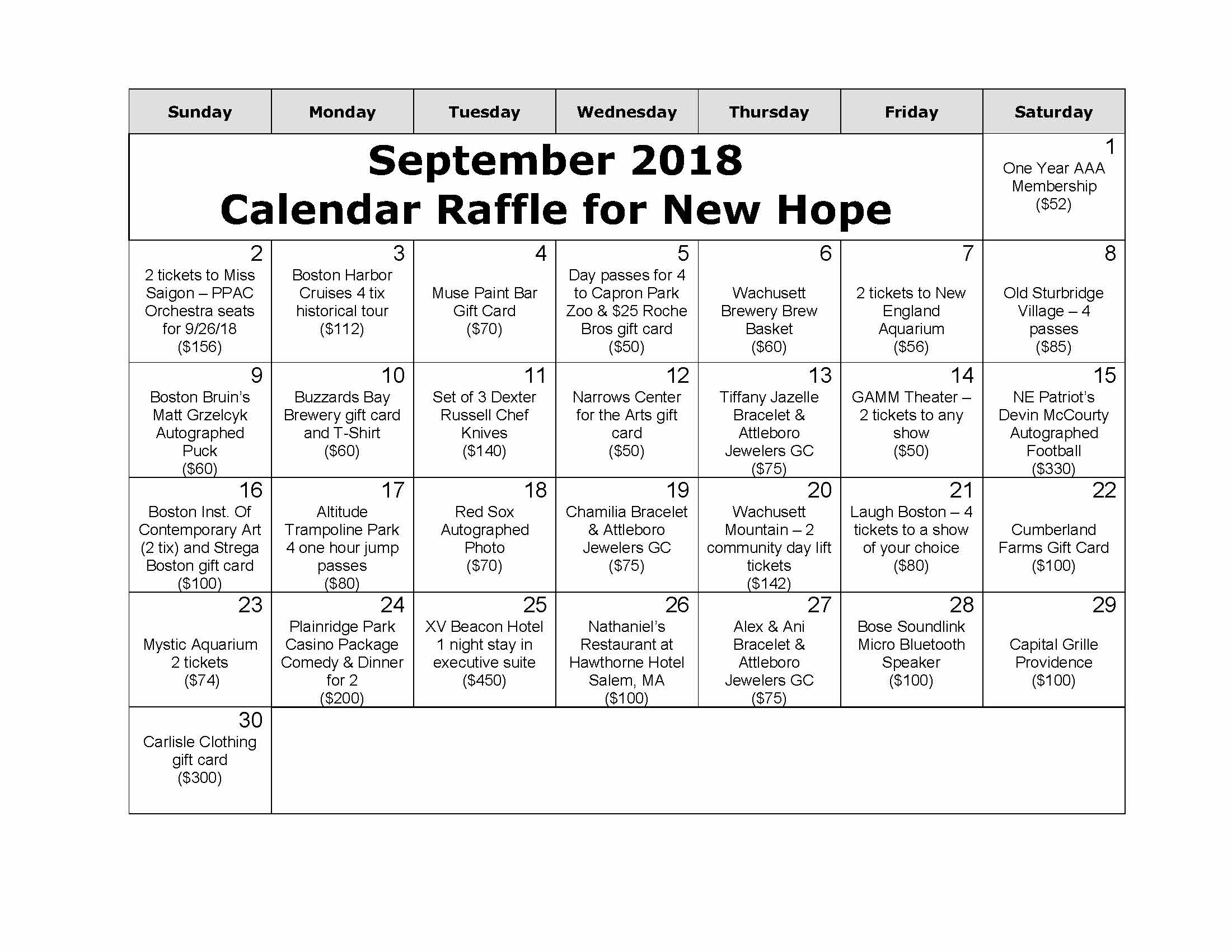

Buy a raffle ticket Australian Red Cross Buy a raffle ticket Enter now for your chance to win great prizes There has never been a better time to enter a Red Cross raffle. Under current Australian government taxation legislation the purchase of Lottery tickets is not tax-deductible as the purchaser has the opportunity to win something in return. A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation.

What do I need to do so that I can claim a tax deduction for my car. In NSW a raffle is a lottery where people buy numbered tickets for a chance to win the prizes offered in the raffle. For example if you bought 100 worth of raffle tickets that did not win but won 500 on a 5 raffle ticket you would have to claim 500 in income but could deduct the 100 you spent on tickets that didnt win.

For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. Read complete answer here. If your organisation is endorsed officially recognised by the Australian Tax Office ATO as a DGR.

There is the chance of winning a prize. However if you only won 50 instead you. If the prize pool is less than 30000 the raffle is classified as a draw lottery.

Plus amount of taxes paid on behalf of winner in box 1 of Form W-2G and the withholding tax in box 2 of Form W-2G. Please use the ACNC Charity Register to determine if a charity has received DGR approval. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

If in Example 3 X pays the withholding tax on Jasons behalf the withholding tax is 333267 10000 fair market value of prize minus 1 ticket cost x 3333. Are Disabled Childrens Foundation Inc. You can only claim a tax deduction for donations to charities and organisations that meet a certain set of criteria.

Donations to crowdfunding appeals often arent tax deductible because you often get some reward the fundraising might be for a number of people or groups or its for medical costs. Also to know is has anyone won the dream house raffle. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

In fact to claim donations you need to be donating to a recognised charitable organisation. It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year. However pins tokens wristbands and stickers are deemed by the ATO as having no material value and are used by the DGR as marketing and promotional material.

Charities rely on the generosity of the people who donate money to support them without the generosity of people like you they wouldnt be able to do the great things they. For specific guidance see this article from the Australian Taxation Office. If you would prefer to make a tax-deductible donation you can by asking during a raffle sales call or using your states RSPCA website donation page links at the bottom of the page.

Generally you can claim donations to charity on your individual income tax returns. Lottery tickets tax deductible. A Deductible Gift Recipient is an organisation with a special tax status.

Creating A Digital Program For Your Fundraiser View A Digital Program Showcasing Auction Items Raffle Items And Fundraising Fundraising Events Event Program

Picking A Good Charity To Donate To And Making The Most Of It With Your Tax Return Abc Everyday

Donations And Deductions Bishop Collins

How To Claim A Tax Deduction On Christmas Gifts And Donations

Sofii Inmemoriam Donation Thankyou Letter Samples Inside Bequest Letter Template Thank You Letter Sample Donation Letter Template Thank You Letter Template

Donation Letter Donation Letter Fundraising Letter Donation Letter Template

501c3 Tax Deductible Donation Letter Donation Letter Template Receipt Template Donation Letter

Tax Deductible Donations An Eofy Guide Good2give

How To Claim Tax Deductible Donations On Your Tax Return

A Guide To Charitable Donations What To Know About Charitable Giving Charitable Donations Donate Logo Donation Logo

Tax Deductible Donations An Eofy Guide Good2give

How To Claim Tax Deductible Donations On Your Tax Return

How To Claim Tax Deductible Donations On Your Tax Return

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Letter For Donations Raffle Basket Ideas Hurray Donation Throughout Donation Card Template Fr Donation Letter Donation Request Letters Donation Letter Template